UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

INREIT Real Estate Investment Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | ||||

| Total fee paid: | ||||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No:

| |||

| ||||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

April 27, 201230, 2013

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of INREIT Real Estate Investment Trust (“Trust”), which will be held on Thursday, June 7, 2012,27, 2013, at 6:00 p.m., Central Standard Time, at the Hilton GardenHoliday Inn located at 4351 173803 13th Avenue South, Fargo, North Dakota 58103. A social reception will precede the shareholder meeting, at 5:00 p.m.

The enclosed Notice of Annual Meeting of Shareholders provides information regarding each business proposal to be voted on at the meeting. These proposals and the vote the Board of Trustees recommends are:

| Recommended | ||||

Proposal | Vote | |||

1. Election of nine (9) | FOR | |||

2. Ratification of the appointment of | FOR | |||

3. To transact such other business as may properly come before the annual meeting or at any adjournment thereof. | FOR | |||

Please see the Notice of Annual Meeting of Shareholders, the Proxy Statement and form of Proxy, which follow this letter, as well as the 20112012 Annual Report. The Proxy Statement contains a more extensive discussion of each proposal, and therefore you should read the Proxy Statement carefully.

The annual meeting will also feature a report on the operations of the Trust, followed by a question and answer period. After the annual meeting, you will have the opportunity to speak informally with the trustees and officers of the Trust.

The Board encourages shareholders to attend the meeting in person. Whether or not you plan to attend the meeting, your vote is important regardless of the number of shares you own. We encourage you to vote by proxy so that your shares will be represented and voted at the annual meeting even if you cannot attend. If you attend the meeting, you may vote in person even if you have previously returned a proxy to us by mail.

Sincerely, |

|

Bruce W. Furness Chairman |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 7, 201227, 2013

To the Shareholders of INREIT Real Estate Investment Trust:

The 20122013 Annual Meeting of Shareholders of INREIT Real Estate Investment Trust (“Trust”), will be held on Thursday, June 7, 2012,27, 2013, starting at 6:00 p.m., Central Standard Time, at the Hilton GardenHoliday Inn located at 4351 173803 13th Avenue South, Fargo, North Dakota 58103, for the following purposes:

| 1. | To elect nine (9) |

| 2. | To ratify the appointment of |

| 3. | To transact such other business as may properly come before the annual meeting and any and all adjournments or postponements thereof, all in accordance with the accompanying Proxy Statement. |

These items are described in the proxy statement, which is part of this notice. We have not received notice of other matters that may properly be presented at the annual meeting.

Our Board of Trustees has chosen the close of business on April 16, 2012,15, 2013, as the record date for determining the shareholders entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements thereof, all in accordance with the accompanying proxy statement.

IF YOU PLAN ON ATTENDING THE MEETING IN PERSON, PLEASE NOTIFY US BY CALLING (701) 837-1031353-2729 OR EMAILING DIVERSON@INREIT.COM,BVANDERHAGEN@INREIT.COM, SO THAT YOU MAY BE PRE-REGISTERED. OTHERWISE, MEETING CREDENTIALS MAY BE OBTAINED AT THE MEETING BY PERSONS IDENTIFYING THEMSELVES AS SHAREHOLDERS AS OF THE RECORD DATE. FOR A RECORD OWNER, POSSESSION OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. FOR A BENEFICIAL-BUT-NOT-OF-RECORD OWNER, A COPY OF A BROKER’S STATEMENT SHOWING SHARES HELD FOR HIS OR HER BENEFIT ON APRIL 16, 201215, 2013 WILL BE ADEQUATE IDENTIFICATION.

By Order of the Board of Trustees, |

|

Bruce W. Furness |

Chairman |

Fargo, North Dakota

April 27, 201230, 2013

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| FINANCIAL STATEMENTS | 3 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 3 | |||

| PROPOSAL 1 | 4 | |||

| 4 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | |||

Process for Identifying and Evaluating Candidates for Election to the Board | 11 | |||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| DIRECTOR COMPENSATION | 12 | |||

| EXECUTIVE OFFICERS | 12 | |||

| EXECUTIVE COMPENSATION | 14 | |||

| 15 | ||||

|

INREIT REAL ESTATE INVESTMENT TRUST

PROXY STATEMENT

FOR THE 20122013 ANNUAL MEETING OF SHAREHOLERS TO BE HELD ON JUNE 7, 201227, 2013

This proxy statement and related documents are furnished by our Board of Trustees for the solicitation of proxies from the holders of our common shares of beneficial interest in connection with the annual meeting of shareholders to be held at the Hilton GardenHoliday Inn located at 4351 173803 13th Avenue South, Fargo, North Dakota 58103, on Thursday, June 7, 2012,27, 2013, at 6:00 p.m. Central Standard Time, subject to any adjournment or postponement thereof. The Notice of Annual Meeting of Shareholders, this Proxy Statement, form of Proxy and the annual report will be mailed to shareholders starting on or about May 7, 2012.April 30, 2013.

VOTING AND REVOCABILITY OF PROXIES

Record Date and Share Ownership

Owners of record of common shares of beneficial interest at the close of business on April 16, 201215, 2013 will be entitled to vote at the annual meeting or adjournments or postponements thereof. As of the close of business on April 16, 2012,15, 2013, there were outstanding 4,536,975.0195,362,954.584 common shares, which is the only class of securities of the Trust entitled to vote at the annual meeting (all such common shares being referred to herein as the “shares” and all holders thereof being referred to as our “shareholders”). Each share is entitled to one vote. There is no cumulative voting for the election of Trustees.trustees.

We will make available a list of holders of record of our shares as of the close of business on April 16, 201215, 2013 for inspection during normal business hours at our offices, 2161711 Gold Drive South, Broadway, Suite 202, Minot, North Dakota 58701.100, Fargo, ND 58103. This list will also be available at the annual meeting. For information regarding security ownership by the Board of Trustees,trustees, management and by the beneficial owners of more than 5% of our securities, see “Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters.”

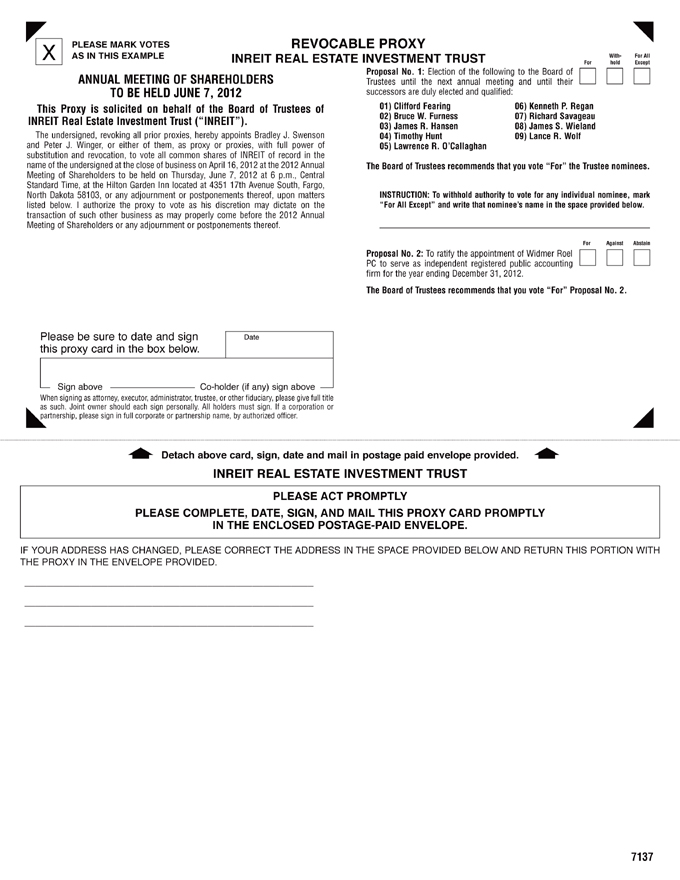

When the proxy materials are delivered, shareholders will receive a proxy card and postage-paid return envelope. Shareholders can ensure that their shares are voted at the annual meeting by signing, dating and returning the proxy in the return envelope. All proxies are to be submitted either by mail or in person at the annual meeting. If shares are held in street name, such shareholders will receive instructions from their broker, bank or other nominee that they must follow to have their shares voted.

All properly executed written proxies delivered pursuant to this solicitation (and not revoked later) will be voted at the annual meeting in accordance with the instructions of the shareholder. Below is a list of the different votes shareholders may cast at the annual meeting pursuant to this solicitation.

In voting on the election of Trusteestrustees to serve until the next annual meeting of shareholders, or until their successors are duly elected and qualified, shareholders may vote in one of the following ways:

| 1. | in favor of a nominee, or |

| 2. |

In voting on the ratification of the appointment of Widmer Roel PCBaker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the year ending December 31, 2012,2013, shareholders may vote in one of the following ways:

| 1. | in favor of the proposal, |

| 2. | against the proposal, or |

| 3. | abstain from voting on the proposal. |

-1-

Shareholders should specify their choice for each matter on the proxy. If no specific instructions are given, proxies which are signed and returned will be votedFORthe election of the Trusteestrustees as set forth herein, andFORthe ratification of the appointment of Widmer Roel PCBaker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the year ending December 31, 2012.2013.

In addition, if other matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy will vote in accordance with their best judgment with respect to such matters. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies. We do not currently know of any other matters to be presented at the annual meeting.

A shareholder submitting a proxy has the power to revoke it at any time prior to its exercise by voting in person at the annual meeting, by giving our SecretaryBrittaney van der Hagen, Investor Relations Coordinator, a written notice bearing a later date than the proxy or by giving a later dated proxy. Attendance at the annual meeting will not in itself constitute a revocation of a proxy. Any written notice revoking a proxy should be sent to our Secretary, Darla Iverson,Brittaney van der Hagen, Investor Relations Coordinator, at INREIT Real Estate Investment Trust, 2161711 Gold Drive South, Broadway, Suite 202, Minot,100, Fargo, ND 58701.58103.

-1-

A quorum of shareholders is required to hold an annual meeting. According to our bylaws, the holders of a majority of the outstanding shares entitled to vote at the annual meeting, represented in person or by proxy, constitute a quorum. If a shareholder has returned valid proxy instructions or attends the annual meeting in person, that shareholder’s shares will be counted for the purpose of determining whether there is a quorum, even if the shareholder wishes to abstain from voting on some or all matters introduced at the annual meeting. Abstentions and “broker non-votes” (shares held by a broker, bank or other nominee that does not have authority, either express or discretionary, to vote on a particular matter) are counted for determining whether there is a quorum. If a quorum is not present, the annual meeting may be adjourned from time to time until a quorum is present.

A plurality of the votes cast is required for the election of the Trusteestrustees to serve until the next annual meeting of shareholders, or until their successors are duly elected and qualified. This means that the Trusteetrustee nominee with the most votes for a particular slot is elected for that slot. Only votes “for” or “withheld” affect the outcome. Abstentions and broker non-votes are not counted for purposes of the election of Trustees.trustees.

Approval of the ratification of the appointment of Widmer Roel PCBaker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the year ending December 31, 20122013 will require the affirmative vote of a majority of the votes cast at the annual meeting, either in person or by proxy, assuming a quorum is present. For this proposal, abstentions and broker non-votes will not be counted as votes for or against this proposal and will have no effect on the outcome of the vote.proposal.

If you were a shareholder as of the close of business on April 16, 2012,15, 2013, you may attend the annual meeting in person. If you want to vote your shares in person and your shares are held in street name, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

The expense of solicitation of proxies will be borne by us, which is estimated to be approximately $8,000. We have not retained a proxy solicitor to solicit proxies; however, we may choose to do so prior to the annual meeting. Proxies may also be solicited by certain of our Trustees,trustees, officers and other employees, without additional compensation, personally or by written communication, telephone or other electronic means. We are required to request brokers, banks and nominees who hold shares in their name to furnish our proxy material to beneficial owners of the shares and will reimburse such brokers, banks and nominees for their reasonable out-of-pocket expenses in so doing.

-2-

The Board of Trustees is not aware of any business other than the aforementioned matters that will be presented for consideration at the annual meeting. If other matters properly come before the annual meeting, it is the intention of the person(s) named in the proxy to vote thereon in accordance with his/their best judgment.

“HOUSEHOLDING” OF PROXY MATERIALS

We are permitted to send only one copy of the Notice of Annual Meeting of Shareholders, Proxy Statement and annual report to eligible shareholders who share a single address unless we have instructions to the contrary from any shareholder at that address. This practice, known as “householding,” reduces printing and mailing costs. If you or another shareholder of record sharing your address would like to receive an additional copy of the Notice of Annual Meeting of Shareholders, Proxy Statement and annual report, we will promptly deliver it to you upon your request in one of the following manners:

By sending a written request by mail to:

Attention: Darla IversonBrittaney van der Hagen

INREIT Real Estate Investment Trust

2161711 Gold Drive South Broadway,

Suite 202100

Minot,Fargo, ND 5870158103

By calling Darla Iverson, the Secretary,Brittaney van der Hagen, Investor Relations Coordinator, at (701) 837-1031353-2729

By emailing a request to diverson@inreit.combvanderhagen@inreit.com

-2-

If you are receiving multiple mailings at one address and would like to request householded mailings, you may do so by contacting Darla IversonBrittaney at (701) 837-1031.353-2729.

Our consolidated financial statements for the year ended December 31, 20112012 are included in our annual report on

Form 10-K filed with the Securities and Exchange Commission on March 30, 201229, 2013 and in our Annual Report that will be mailed to our shareholders either before or concurrent with this Proxy Statement. In addition, our Form 10-K will be sent to our shareholders upon request. The Form 10-K and the Annual Report do not form any part of the material for the solicitation of proxies.

-3-

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows, as of April 16, 2012,15, 2013, the beneficial ownership of common shares of the Trust and of limited partnership units of our operating partnership, which are exchangeable for common shares on a one-for-one basis or cash, at the option of the Trust, by (1) any person who is known by us to be the beneficial owner of more than 5% of the outstanding common shares of the Trust, (2) each trustee and nominee for trustee of the Trust, (3) each executive officer of the Trust and (4) all of the trustees and executive officers of the Trust as a group. The calculation of the percentage of outstanding shares is based on 4,536,975.0195,362,954.584 common shares outstanding on April 16, 2012.15, 2013. Except as otherwise indicated by footnote, each shareholder named has sole voting and investment power with respect to such common shares and limited partnership units.

| Common Shares Beneficially Owned (2) | Limited Partnership Units Beneficially Owned(2)(3)(4) | Percentage of Common Shares and Units(6) | Common Shares Beneficially Owned (2) | Limited Partnership Units Beneficially | Percentage Common | |||||||||||||||||||||||||||

Name of Beneficial Owner(1) | Number(4)(5) | Percentage(5) | Number (4)(5) | Percentage (5) | Owned (2)(3)(4) | and Units (6) | ||||||||||||||||||||||||||

Peggy Becker | 14,383 | (7) | * | 0 | * | |||||||||||||||||||||||||||

Clifford Fearing | 30,584 | (8) | * | 0 | * | 30,652 | (7) | * | 0 | * | ||||||||||||||||||||||

Bruce W. Furness | 25,165 | * | 57,704 | 1.80 | % | 33,969 | (8) | * | 67,324 | 1.69 | % | |||||||||||||||||||||

James R. Hansen | 184,680 | (9) | 4.07 | % | 316,877 | (9) | 11.05 | % | 193,771 | (9) | 3.61 | % | 316,877 | (9) | 8.90 | % | ||||||||||||||||

Timothy Haugen | 28,477 | (10) | * | 0 | ||||||||||||||||||||||||||||

Timothy Hunt | 7,441 | * | 8,775 | (10) | * | 19,441 | * | 8,775 | (11) | * | ||||||||||||||||||||||

Darla Iverson | 290 | (11) | * | 0 | * | |||||||||||||||||||||||||||

Lawrence R. O’Callaghan | 29,670 | (12) | * | 0 | * | 30,045 | (12) | * | 0 | * | ||||||||||||||||||||||

Kenneth P. Regan | 30,060 | * | 1,415,925 | (13) | 23.79 | % | 130,060 | 2.43 | % | 1,368,124 | (13) | 20.40 | % | |||||||||||||||||||

Bradley J. Swenson | 9,698 | * | 0 | * | 10,317 | * | 0 | * | ||||||||||||||||||||||||

Richard Savageau | 12,092 | (14) | * | 322,487 | (14) | 11.01 | % | 212,562 | (14) | 3.96 | % | 322,487 | (14) | 9.41 | % | |||||||||||||||||

James W. Wieland | 30,000 | * | 1,207,195 | (15) | 21.54 | % | 66,930 | 1.25 | % | 1,153,533 | (15) | 16.73 | % | |||||||||||||||||||

Lance R. Wolf | 25,494 | (16) | * | 12,174 | * | 29,253 | (16) | * | 12,174 | * | ||||||||||||||||||||||

Peter J. Winger | 779 | * | 0 | * | 672 | (17) | * | 0 | * | |||||||||||||||||||||||

All Trustees and Executive Officers as a group (12 individuals) | 400,336 | 8.82 | % | 3,341,137 | 47.50 | % | 786,149 | 14.66 | % | 3,249,294 | 44.82 | % | ||||||||||||||||||||

| * | Less than 1% of the outstanding common shares of beneficial interest. |

| (1) | Unless otherwise indicated, the address of each beneficial owner is |

| (2) | The amounts of common shares and units beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. |

| (3) | Upon the expiration of an initial mandatory holding period, |

| (4) | Share and unit amounts have been rounded to the nearest whole number. |

-4-

| (5) | Each figure showing the number and percentage of outstanding common shares owned beneficially does not include the number of common shares which may be issued to the indicated persons pursuant to the Exchange Right. |

| (6) | Each figure showing the percentage of common shares and units beneficially owned has been calculated by treating as outstanding and owned the common shares which may be acquired by the indicated person pursuant to the Exchange Rights, |

| (7) |

| Consists of 22,673 shares held individually and |

-3-

| (8) | Shares held jointly with spouse. |

| (9) | Shares consist of |

| (10) | Shares are held in an IRA account. |

| (11) | Units are owned by his spouse. |

| (12) | Consists of |

| (13) | Consists of |

| (14) | Shares consist of |

| (15) | Consists of |

| (16) |

-5-

| (17) | Shares held jointly with spouse. |

ELECTION OF TRUSTEES

Our shareholders are asked to act upon a proposal to elect the trustee nominees. Our Board of Trustees is presently composed of tennine (9) trustees. The term of the current trustees will expire at the annual meeting. Peggy BeckerMr. Larry R. O’Callaghan has notified the Nomination and Governance Committee that shehe will not stand for re-election and herhis service as a trustee will expire at the end of this annual meeting.

The Board of Trustees has nominated nine (9) nominees for election to the Board of Trustees: Clifford Fearing, Bruce W. Furness, James R. Hansen, Timothy Haugen, Timothy Hunt, Lawrence R. O’Callaghan, Kenneth P. Regan, Richard Savageau, James S. Wieland and Lance R. Wolf. TheseAll nominees, allwith the exception of Timothy Haugen, currently serve as members of our Board of Trustees. Each trustee is to serve until the next annual meeting of our shareholders and until his successor has been duly elected and qualified, or until the trustee’s earlier death, resignation or termination. All the nominees have indicated a willingness to serve if elected.

A plurality of the votes cast is required for the election of the trustees to serve until the next annual meeting of shareholders, or until their successors are duly elected and qualified. This means that the trustee nominee with the most votes for a particular slot is elected for that slot. Only votes “for” or “withheld” affect the outcome. Abstentions are not counted for purposes of the election of trusteestrustees.

Unless a contrary choice is specified, proxies solicited by our Board of Trustees will be votedFORapproval of the election of each of the trustee nominees.

A shareholder has one vote per share for each trustee nominee. Cumulative voting does not apply in the election of trustees. Proxies may not be voted for a greater number of persons than the trustee nominees.

Recommendation of our Board of Trustees

Our Board of Trustees recommends a vote FOR each of the trustee nominees to hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified.

-4-

Biographical and other information concerning our current trustees and the trustee nominees for election at the annual meeting is set forth below.

Name | Age* | Current Positions | Member Since | |||||

Kenneth P. Regan | 56 | Chief Executive Officer and Trustee | July 2007 | |||||

Bruce W. Furness | 73 | Chairman of the Board, Nomination and Governance Committee Member, Chair of Executive Committee | Board: May 2008 Committee: 2010 Committee: 2008 | |||||

| 69 | Trustee, Audit Committee Member, Disclosure Committee Member |

| |||||

|

| Board: March 2005 Committee: 2009 Committee: 2011 | ||||||

James R. Hansen | 67 | Trustee, Executive Committee Member, Nomination and Governance Committee Member | Board: May 2010 Committee: 2010 Committee: 2011 |

-6-

Timothy Haugen | 57 | Nominee | ||||||

Timothy Hunt | 62 | Trustee, Executive Committee Member, Chair of Audit Committee

| Board: Committee: 2008 Committee: 2011 | |||||

Lawrence R. O’Callaghan(1) | 63 | Trustee, Nomination and Governance Committee Member, Disclosure Committee Member | Board: January 2003 Committee: 2010 Committee: 2011 | |||||

Richard Savageau | 78 | Trustee, Executive Committee Member Chair of Nomination and Governance Committee | Board: May 2009 Committee: 2011 Committee: 2010 | |||||

James S. Wieland | 61 | Trustee, Nomination and Governance Committee Member, Executive Committee Member | Board: June 2007 Committee: 2010 Committee: 2009 | |||||

Lance R. Wolf | 65 | Trustee, Audit Committee Member, Chair of Disclosure Committee | Board: May 2010 Committee: 2010 Committee: 2011 |

| * | As of April |

| (1) | Term will expire after the annual meeting, and is not a nominee for election to the Board of Trustees at the annual meeting. |

Kenneth P. Reganhas served as a trustee since July 2007 and as our Chief Executive Officer since May 2007. He has also has served as the Chief Executive Officer and Chairman of the Board of INREIT Management, LLC, our Advisor, since May 2007. Mr. Regan has over 31 years of experience in the real estate industry. In March 1981, he cofounded the GOLDMARK companies with James Wieland. Mr. Regan is the Chief Executive Officer, Chairman and co-owner of GOLDMARK Property Management, Inc., one of our property managers, andmanagement firms. He is the Chief Executive Officer, Chairman and co-owneralso an owner of both GOLDMARK Schlossman Real Estate Services, Inc. and GOLDMARK Development Corporation. During his service to the GOLDMARK companies, Mr. Regan has been active in the acquisition, development, operation and management of multifamily and commercial real estate. Prior to co-founding the GOLDMARK companies, he began his real estate career in 1979 with Warner and Company, located in Fargo, ND. Prior, to that, Mr. Regan worked as an Assistant National Bank Examiner for the OCC Division of the U.S. Treasury. He received a B.S.B.A. degree in Business Management from the University of North Dakota, and is a Certified Commercial Investment Member (CCIM), Certified Property Manager (CPM) and has earned the Graduate Realtors Institute (GRI). designation. Mr. Regan is also a member of the FM Apartment Association, FM Area Association of Realtors and the National Association of Realtors.

Mr. Regan was nominated for electionselection to the Board of Trustees because of his specific experience and expertise with multi-family properties, property management and the investment real estate industry; past and continuing contributions to us as Trustee,trustee, Chief Executive Officer and an investor; and his general expertise and perspective on business and real estate that benefit the Trust.estate.

-5-

Bruce W. Furnesshas served as our Chairman of the Board since June 2011 and served as Vice Chairman of the Board from May 2008 to June 2011. Mr. Furness currently serves as the Chair of our Executive Committee and as a member of our Nomination and Governance Committee. Previously, Mr. Furness served as the Vice President for business relations and development of the State Bank & Trust (n/k/a Bell State Bank & Trust) of Fargo from June 2006 through March 2008, when he was appointed interim Chief Executive Officer of the North Dakota Workforce Safety & Insurance Agency, until he retired in March 2009. Mr. Furness was elected to the Fargo City Commission in 1992, and served as the Mayor of the City of Fargo, ND from April 1994 to June 2006. He worked with the Greater North Dakota Association from 1992 through 1996.1995. In addition, he was employed by International Business Machines (IBM) (NYSE: IBM) for 30 years, including management positions in several locations. Mr. Furness currently servesserved as a director for theBell State Bank & Trust of Fargo, ND (and isas a member of their audit committee), for 24 years. He currently serves as a director for Lake Agassiz Water Authority, Tri-College University, The Consensus Council, Red River Zoo,CHARISM Neighborhood Support Centers, the FM Area Foundation and the Metro Sports Foundation. Mr. Furness received a Bachelor of Science degree in Mathematics from Jamestown College and a Master’s degree in Mathematics from Montana State University.

-7-

Mr. Furness was nominated for election to the Board of Trustees because of his specific experience and expertise in governance, management, and the computer industry and municipal experience;matters; past and continuing contributions to us as a Trusteetrustee and investor; and his general expertise and perspective on banking, business and real estate that benefit the Trust. Mr. Furness’ distinguished service to the City of Fargo, as Mayor, and State of North Dakota as Interim Chief Executive Officer of the North Dakota Workforce Safety & Insurance agency also provides many benefits to us and our Board of Trustees.

Peggy Beckerhas served as a trustee of the Board since January 2003. Ms. Becker currently serves on our Audit Committee and our Disclosure Committee. Ms. Becker owned and managed the Little Cottage Café from 1985 until 1997, when she sold the business. She purchased Armstrong Sanitation Plus, a garbage and rubbish removal business, in 1993, which she still owns and continues to manage.

Clifford Fearinghas served as one of our trustees since March 2005. He currently serves on our Audit Committee and our Disclosure Committee. Mr. Fearing has over 35 years of accounting experience. From 1997 to April 1999, he served as the Financial Officer of Fairview Health Services until he retired in 1999. Prior, to that, he worked at the University of Minnesota Hospitals and Clinics as Accounting Supervisor from 1969 until 1974, when he became Chief Financial Officer until 1996. From May 1967 through February 1969, Mr. Fearing was an acquisition accountant for International Multifoods. Mr. Fearing worked as a tax accountant for Boulay, Heutmaker, Zibell & Co. from October 1966 through April 1967 and as a junior auditor for Lybrand, Ross Brothers and Montgomery, Inc. from August 1965 through September 1966. Mr. Fearing received a B.A. degree in Accounting from the University of Minneapolis, Duluth.

Mr. Fearing was nominated for election to the Board of Trustees because of his specific experience and expertise in the accounting and health care industries; past and continuing contributions to us as a Trusteetrustee and investor; and his general expertise and perspective on acquisitions, business and real estate that benefit us.estate.

James R. Hansenhas served as one of our trustees since May 2010. Mr. Hansen currently serves on our Executive Committee and our Nomination and Governance Committee. After serving in the U.S. Army, Mr. Hansen began his career in the automotive industry, where he was a partner of Hansen Automotive Group in Grand Forks until the business was sold in 2006. He is the owner and manager of Hansen Investments, Inc., which included an ABRA Body and Glass franchise since 2002 and an Avis Auto rental franchise since 1989. He was the owner and manager of Hansen Cycle and Marine, Inc., which sold and serviced Honda motorcycles and marine products, from 1989 to 2008; the owner and manager of Hansen Ford Lincoln Mercury, Inc., which sold and serviced new and used Ford Motor Company products, from 1954 to 2006; and partner in Auto Finance Super Center, Inc., which sold and financed used vehicles in Grand Forks, Fargo and Bismarck, ND, from 1986 to the present. He is also a partner in Northstar Telecom, Inc., which sells Verizon cellular telephones in Grand Forks and Fargo, ND and Thief River Falls, MN, from 2002 to the present. Mr. Hansen received a B.S. degree in Business Administration from the University of North Dakota.

Mr. Hansen was nominated for election to the Board of Trustees because of his specific experience and expertise in operating and managing numerous businesses in various industries; past and continuing contributions to us as a Trusteetrustee and investor; and his general expertise and perspective on business and real estate that benefit us.estate.

Timothy L. Haugen has over 37 years of experience in corporate and business accounting, is a Certified Public Accountant and currently serves as Vice President of Orthopedics and Sports Medicine for Sanford Health, Fargo, North Dakota. From 1988 to 2010, Mr. Haugen served as Administrator for the clinic and surgery center divisions of Orthopaedic Associates where he was responsible for all administrative duties, including accounting, marketing, human resources, contracting, planning, payroll and accounts payable. Prior to his time with Orthopedic Associates, Mr. Haugen worked for St. Lukes Hospital, as a Budget and Cost Accountant and for the State of North Dakota as a Tax Auditor. Mr. Haugen currently serves on the board of the Hospice of the Red River Valley and has previously served on the board for Vision Services of North Dakota and Community Living Services. Mr. Haugen received a B.S. degree in Business Administration from the University of North Dakota.

Mr. Haugen was nominated for election to the Board of Trustees because of his specific experience and expertise in accounting functions and the medical industry; past and continuing contributions to us as an investor; and his knowledge, expertise and perspective on business, planning, construction and financing.

Timothy Hunthas served as one of our trustees since October 2003. Mr. Hunt currently serves as the Chair of our Audit Committee and as a member of our Executive Committee. Mr. Hunt has over 30 years of experience in healthcare administration. He has served as the Chief Executive Officer of Alexandria Clinic, PA, a 36-physician clinic in Alexandria, MN since 1990. Throughout his career as a hospital and clinic CEO he has gained experience in the planning and construction of multiple healthcare facilities. He is a fellow in the American College of Healthcare Administrators, and a past Board member of the Minnesota Medical Group Management Association. Mr. Hunt also serves as the administrator of a large, corporate retirement plan, and has experience in the investment and management of personal real estate income properties. Mr. Hunt received a Master’s degree in Healthcare Administration from the University of Minnesota. Mr. Hunt currently serves on the Board of Directors and the audit committee of Bremer Trust.

-6-

Mr. Hunt was nominated for election to the Board of Trustees because of his specific experience and expertise in executive management and healthcare administration; past and continuing contributions to us as a Trusteetrustee and investor; and his general expertise and perspective on the planning and construction of health care facilities that benefit us.facilities.

-8-

Lawrence R. O’Callaghanhas served as a trustee since January 2003. Mr. O’Callaghan currently serves on our Disclosure Committee and our Nomination and Governance Committee. As an original member of the Trust, O’Callaghan served as the Chairman of the Board in 2003. He has been an investment and securities advisor since 1983, and is affiliated with Financial Advantage Wealth Management, LLC in Fargo, ND. Prior, to that, Mr. O’Callaghan worked with large brokerage firms including EF Hutton and AG Edwards, and is currently an advisor with International Assets Advisory, LLC. With a long association with REITs, he has raised millions of investment capital for REITs since 1992. Mr. O’Callaghan has also been a life and health insurance agent since 1974. From 1979 to 1984, he was a co-owner of O.R.K., Inc., an insurance agency in Bismarck, ND. This agency was among the first in the United States to use new desktop technology creating point of sale illustrations for Universal Life insurance contracts, and its software was marketed across the nation for several years. Since 2006, O’Callaghan has been a realtor with Pifer’s Auction & Realty. His work with agriculture and commercial real estate and investment securities — including REITs — allow him to work with clients using tax-deferred exchanges and the IRC tax codes of 1031 and 721 UPREITs. He received a A.A. degree and a Certification in Computer Programming and System Analysis from Bismarck State College. He received certification as a Certified Senior Advisor (CSA) in 2001.

Mr. O’Callaghan was nominated for election to the Board of Trustees because of his specific experience and expertise in the securities and REIT industries; past and continuing contributions to us as Trustee and an investor; and his general expertise and perspective on business and real estate that benefit us.

Richard Savageauhas served as one of our trustees since May 2009. He currently serves as Chair of the Nomination and Governance Committee and is a member of the Executive Committee. Previously, Mr. Savageau served in various positions with Caterpillar, Inc. (NYSE: CAT) — Butler Machinery Company: President from 1986 through 1998, Executive Vice President from 1981 to 1986, Vice President & CFO from 1979 to 1981, General Manager I & I Division from 1975 to 1977 and Finance Manager from 1970 to 1975. He also served as the Finance Manager for General Motors Acceptance Corporation (now known as Ally Financial, Inc.), a wholly-owned subsidiary of General Motors Corporation, from 1960 to 1965. From 1965 to 1970, he was a Sales Executive with A.H. Robins Pharmaceutical. Mr. Savageau has served and currently serves on several boards, including St. Johns Hospital Fargo, Hospice of the Red River Valley, Riverview Seniors Living Center, Grow Parochial Fund, Associated Equipment Dealers, F-M Credit Manager, St. Anthony’s Parish and School, Dean Real Estate. More recently, he has presided over several commercial and residential real estate developments. Mr. Savageau received a B.S. degree in Science and Mathematics from North Dakota State University, and a degree in Education at the North Dakota State University. He also served in the U.S. Army in the Infantry Medical Corp.

Mr. Savageau was nominated for election to the Board of Trustees because of his specific experience and expertise in executive leadership, real estate development and accounting industry; past and continuing contributions to us as a Trusteetrustee and an investor; and his general expertise and perspective on business and real estate that benefit us.estate.

James S. Wielandhas served as one of our trustees since June 2007. He currently serves on our Executive Committee and our Nomination and Governance Committee. Mr. Wieland also serves on the Board of Governors of INREIT Management, LLC, our Advisor, since January 2007, and is an owner of the Advisor, indirectly through Wieland Investments, of which Mr. Wieland is the general partner. Mr. Wieland has over 33 years of experience in property investment, management, brokerage and development. In March 1981, he cofounded the GOLDMARK companies with Kenneth Regan. Mr. Wieland is the Vice President and co-owner of GOLDMARK Property Management, Inc., one of our property managers, and is the President, Managing Partner and co-owner of GOLDMARK Schlossman Real Estate Services, Inc. and Vice President and co-owner of GOLDMARK Development Corporation. During his service to the GOLDMARK companies, Mr. Wieland has been active in the acquisition, development, operation and management of multifamily and commercial real estate. Mr. Wieland currently serves and has served on various boards, including for Bell State Bank and Trust, Dakota Renaissance Ventures, Space Age Technology, Jamestown Community Hospital, North Dakota State University Team Makers, NDSU College of Business, Cass County Electric Cooperative, Northern Capital Trust, Production Publications, Inc. and the Walton Bean Cooperative. Mr. Wieland received a B.S. degree in Business Economics and a Master’s degree in Agricultural Economics from the North Dakota State University.

-9-

Mr. Wieland was nominated for election to the Board of Trustees because of his specific experience and expertise with multi-family properties, property management and the real estate industry; past and continuing contributions to us as Trusteetrustee and an investor; and his general expertise and perspective on business and real estate that benefit us.estate.

Lance R. Wolfhas served as one of our trustees since May 2010. He currently serves as Chair of the our Disclosure Committee and as a member of our Audit Committee. Currently, Mr. Wolf serves as the Executive Vice President and Director of Retail Banking of Gate City Bank since 2000, and chairs its Compliance Committee. Prior, to that, he served in various positions with Gate City Bank or its affiliates: Senior Vice President and Director of Retail Banking at Gate City Federal Savings Bank from 1993 to 2000; Vice President of Gate City Federal Savings Bank from 1986 to 1993; Branch Coordinator from 1983 to 1993; and Branch Manager of Gate City Federal Savings Bank from 1979 to 1983. Mr. Wolf also serves on the Open Compliance Committee for the American Bankers Association and the Board of Regents of the University of Mary, Bismarck, ND. Mr. Wolf received a B.S. degree in physical education, biology and chemistry from the North Dakota State University.

-7-

Mr. Wolf was nominated for election to the Board of Trustees because of his specific experience and expertise in regulatory compliance and the retail banking industry; past and continuing contributions to us as Trusteetrustee and an investor; and his general expertise and perspective on business and real estate that benefit us.estate. Wolf’s distinguished service on the Open Compliance Committee for the American Bankers Association also provides many benefits to us and our Board of Trustees.

CORPORATE GOVERNANCE, BOARD OF DIRECTORS AND COMMITTEES

Our Board of Trustees has determined that sevensix of our tennine (9) current Trustees—trustees—Messrs. Fearing, Furness, Hansen, Haugen, Hunt, Savageau and Wolf and Ms. Becker—Wolf—are independent under the standards of the Nasdaq Stock Market, and the majority of the members of our Audit Committee are independent pursuant to Rule 10A-3 of the Securities and Exchange Act of 1934.

We operate under the direction of our Board of Trustees, the members of which are accountable to us and our shareholders as fiduciaries. The Board is responsible for the overall management and control of our affairs. Our Chairman of the Board, Bruce W. Furness, is an independent Trusteetrustee under the independence standards described above.

The Board has retained INREIT Management, LLC as our Advisor to manage our day-to-day affairs and the acquisition and disposition of our investments, subject to the board’s supervision and approval. Kenneth P. Regan, our Chief Executive Officer; Bradley J. Swenson, our President;President and Secretary; and Peter J. Winger, our Chief Financial Officer and Treasurer; and Darla Iverson, our Secretary,Treasurer are also officers, employees, owners or governors of our Advisor. Among others, such executive officers oversee our Advisor’s day-to-day operations with respect to us. However, when doing so, such executive officers are acting on behalf of our Advisor in performing the Advisor’s obligations under the Advisory Agreement. Generally, the only services performed by our executive officers in their capacity as executive officers are those required by law or regulation, such as executing documents as required by North Dakota law and providing certifications required by the federal securities laws.

Under our board leadership structure, the roles of Chief Executive Officer and Chairman of the Board are separate. The separation of offices allows the Chairman of the Board to focus on board management matters and to maintain the objectivity of the Board in its risk oversight role and management oversight role of the Advisor, specifically with respect to reviewing and assessing the Advisor’s performance.

-10-

Our Board of Trustees held four regularly scheduled meetings and no special meetings during 2011.2012. In 2011,2012, the Board of Trustees did not act by unanimous written consent in lieu of a meeting. During 2011,2012, all trustees attended 75% or more of the meetings of the Board of Trustees and committees to which they were assigned.

In order to control expenses, and in light of the fact that very fewa limited number of our shareholders attend our annual or special meetings of shareholders in person, we do not require trustees to attend shareholder meetings. Our trustees are invited, and frequently one or more of our trustees is in attendance at such meetings. At the 20112012 annual meeting of shareholders, nineall of our trustees were present.

Our Board of Trustees next regular meeting is scheduled for June 7, 2012,27, 2013, prior to the annual shareholder meeting.

We have a standing Audit Committee, Nomination and Governance Committee, Disclosure Committee and Executive Committee, each of which is more fully described below.

Our entire Board of Trustees considers all major decisions concerning our business, including property acquisitions and dispositions. However, we have established an Audit Committee, so that audit functions can be addressed in more depth than may be possible at a full Board meeting, as well as a Nomination and Governance Committee, Disclosure Committee and Executive Committee.

The Audit Committee’s primary functions are overseeingto oversee our accounting, and financial reporting, and disclosure processes and the audits of our financial statements. The committee recommends for approval by our Board of Trustees anselects the Trust’s independent registered public accounting firm to audit our consolidated financial statements, for the fiscal year in which they are appointed, and monitors the effectiveness of the audit effort, and the effectiveness of the Trust’s internal and financial accounting organization, and controls and financial reporting. The duties of the committee are also to overseeoversees and evaluateevaluates the independent registered public accounting firm, to meetmeets with the independent registered public accounting firm to review the scope and results of the audit, to approveapproves non-audit services provided to us by our independent certified public accountants, and to considerconsiders various accounting and auditing matters related to our system of internal controls, financial management practices and other matters. The committee complies with the provisions of the Sarbanes-Oxley Act of 2002.

-8-

The Audit Committee currently consists of Board members Peggy Becker, Clifford Fearing, Timothy Hunt and Lance R. Wolf, and is chaired by Timothy Hunt. Mr. Hunt has served as Chair of this committee from June 2011 to the present. The members of the Audit Committee are independent trustees, as defined in Rule 5605(a)(2) of the Nasdaq Marketplace Rules and as defined by the Sarbanes-Oxley Act of 2002. Our Board of Trustees has determined that we have at least one Audit Committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K, one of which is Timothy Hunt.

The Audit Committee meets at least quarterly to review and approve the financial reports, and to discuss accounting, reporting and internal control matters, and review other pertinent matters as they arise. The Audit Committee also discusses auditing issues via telephone conference and during regularly scheduled Board meetings, as appropriate, after which time the conversations are incorporated into Board’s minutes. The committee held five meetings during 2011.2012.

We have anOur Audit Committee Charter which was filed as Annex C to our Definitive Proxy Statement on Schedule 14A filed with the SEC on May 27, 2011. The text of the charter is notalso available on our website but our website provides a link to our SEC filings located on the SEC’s website.

-11-

Nomination and Governance Committee

The Nomination and Governance Committee’s primary functions are to assist the Board in overseeing company governance matters, including the development of company governance guidelines; periodic evaluation of the Board, its committees and individual trustees; identification and selection of trustee nominees; and oversight of our policies and practices relating to ethical and compliance issues.

The committee is responsible for assessing the appropriate mix of skills and characteristics required of Board members and shall periodically review and recommend for approval by the Board any updates to the criteria as deemed necessary. Such criteria may include integrity, independence, diversity and extent of experience, length of service, number of other Board and committee memberships, leadership qualities and ability to exercise sound judgment. The committee will evaluateevaluates the qualifications of each trustee candidate against these criteria in making its recommendation to the Board concerning nominations for election or reelection as a trustee.

The Nomination and Governance Committee currently consists of Board members Bruce Furness, James Hansen, Lawrence R. O’Callaghan, Richard Savageau and James Wieland, and is chaired by Richard Savageau. The current slate of trustee nominees was recommended to the Nomination and Governance Committee by our management and the Advisor, and shareholders.Advisor.

The Nomination and Governance Committee meets at least twice a year, and holds additional meetings when pertinent matters arise. This committee also discusses governance issues via telephone conference and during regularly scheduled Board meetings, after which time the conversations are incorporated into the Board’s minutes. The committee held two meetings during 2011.2012.

We have aOur Nomination and Governance Committee Charter which was filed as Annex D to our Definitive Proxy Statement on Schedule 14A filed with the SEC on May 27, 2011. The text of the charter is notalso available on our website but our website provides a link to our SEC filings located on the SEC’s website.at www.inreit.com.

The Disclosure Committee’s primary functions are to assist the Board in overseeing the integrity of our public filings and compliance with our public disclosure and reporting requirements.

The Disclosure Committee currently consists of Board members Peggy Becker, Clifford Fearing, Lawrence R. O’Callaghan and Lance R. Wolf, and is chaired by Mr. Wolf.

The Disclosure Committee meets at least four times a year. This committee also discusses disclosure issues via telephone conference and during regularly scheduled Board meetings, after which time the conversations are incorporated into the Board’s minutes. The committee held twofour meetings during 2011.2012.

We have aOur Disclosure Committee Charter which was filed as Annex E to our Definitive Proxy Statement on Schedule 14A filed with the SEC on May 27, 2011. The text of the charter is notalso available on our website but our website provides a link to our SEC filings located on the SEC’s website.at www.inreit.com.

-9-

The Executive Committee’s primary functions are to assist the Board in handling matters which should not be postponed until the following scheduled meeting of the Board of Trustees, including in connection with capital expenditures, investments, acquisitions, dispositions and financing activities. Prior to February 2011, this committee was previously known as the executive acquisition committee.

The Executive Committee currently consists of Board members Bruce W. Furness, James Hansen, Timothy Hunt, Richard Savageau and James S. Wieland, and is chaired by Mr. Furness.

-12-

The Executive Committee will meetmeets periodically when necessary or deemed desirable by the committee or the Chair of the Committee. The committee held threefour meetings during 2011.2012.

We have anOur Executive Committee Charter which was filed as Annex F to our Definitive Proxy Statement on Schedule 14A filed with the SEC on May 27, 2011. The text of the charter is notalso available on our website but our website provides a link to our SEC filings located on the SEC’s website.at www.inreit.com.

The Board of Trustees may determine to establish additional committees of the Board in the future.

Compensation Committee Interlocks and Insider Participation

We do not have a separate compensation committee, or other Board committee performing equivalent functions, as we do not compensate our executive officers. Therefore, there is no current or prior relationship to any other company required to be described under the Securities and Exchange Commission rules relating to disclosure of executive compensation.

Qualifications of Candidates for Election to the Board

When candidates for our Board of Trustees are considered, the Nomination and Governance Committee will consider all relevant experience and qualifications of the nominees, and each candidate is evaluated based upon various criteria including integrity, independence, diversity and extent of experience, length of service, number of other board or committee memberships, leadership qualities and the ability to exercise sound judgment. Additional considerations include:

| • | Representation of |

| • | Judgment and Knowledge.The candidate demonstrates judgment and knowledge in the ability to assess our strategy, business plans, management evaluation and other key issues. The candidate is sufficiently informed and knowledgeable to contribute effectively to the Board’s monitoring responsibilities. |

| • | Meaningful Participation.The candidate is comfortable being an active, inquiring participant. The candidate participates in the Board process in a meaningful way. The candidate has confidence and willingness to express ideas and engage in constructive discussion. The candidate actively participates in decision-making and is willing to make tough decisions. The candidate is diligent and faithful in attending Board and committee meetings. |

| • | Communications.The candidate communicates freely with other Board members. The candidate is a good sounding board for other |

| • | Expertise. The candidate fulfills specific Board needs. The candidate makes his/her own individual expertise available to the Board. The candidate draws on relevant experience in addressing issues facing us. The candidate is willing to respond to appropriate requests of the Chief Executive Officer outside of Board meetings for advice and support. |

-13-

| • | Vision and Leadership.The candidate understands our philosophy and strategy. The candidate is oriented toward the future, and sensitive to future direction of the real estate investment trust (REIT) industry. The candidate fulfills his/her legal and fiduciary responsibilities. The candidate supports our mission and values, and is open, honest and direct. The candidate makes appropriate time commitment for Board service and has no conflict of interest in serving on the Board. |

| • | Professional Status. The candidate has standing and reputation in the business, professional and social communities in which we operate. The candidate appropriately represents us in all such communities. |

-10-

Process for Identifying and Evaluating Candidates for Election to the Board

A role of the Nomination and Governance Committee is to review the qualifications and backgrounds of any candidates for our Board of Trustees, its current members, as well as the overall composition of the Board. Only members of the Nomination and Governance Committee who are deemed independent Trusteestrustees may perform the nomination responsibilities of the committee.

The Nomination and Governance Committee will consider candidates proposed by our shareholders as well as those recommended by theand holders of a majority of the outstanding limited partnership units in INREIT Properties, LLLP, our operating partnership. The Nomination and Governance Committee will not change the manner in which it evaluates candidates, including the applicable minimum criteria set forth above, on the basis of whether the candidate was recommended by a shareholder or a limited partners.partner.

In the case of any trustee candidate, the questions of independence and financial expertise are important to determine what roles the candidate can perform, and the Nomination and Governance Committee will consider whether the candidate meets the applicable independence standards and the level of the candidate’s financial expertise. Any new candidates will be interviewed, and the Nomination and Governance Committee will approve the final nominations. Our chairmanChairman of the Board, acting on behalf of the Nomination and Governance Committee, will extend the formal invitation to the selected candidates.

Shareholders may nominate Trusteetrustee candidates for consideration by the Nomination and Governance Committee by writing to our Secretary, who will forward the nomination to the Chairman of the Nomination and Governance Committee. The shareholder will be required to comply with the requirements of our Amended and Restated Bylaws regarding time frames during which to submit trustee candidates and the submission process. The submission must provide, among other things, the candidate’s name, biographical data and qualifications, including five-year employment history with employer names and a description of the employer’s business; whether such individual can read and understand fundamental financial statements; other board memberships (if any); ownership of our shares or limited partnership units in our operating partnership; and such other information as is reasonably available and sufficient to enable the Nomination and Governance Committee to evaluate the minimum qualifications stated above under the section of this proxy statement entitled “Qualifications of Candidates for Election to the Board.” The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Nomination and Governance Committee and to serve if elected by the shareholders. If a shareholder nominee is eligible, and if the nomination is proper, the Nomination and Governance Committee then will deliberate and make a decision as to whether the nominee will be approved and subsequently submitted to our shareholders for a vote. The Nomination and Governance Committee will not change the manner in which it evaluates candidates, including the applicable minimum criteria set forth above, on the basis of whether the candidate was recommended by a shareholder.

Executive Sessions of the Board

In 2011, our Board of Trustees adopted a policy of meeting in executive session, with only independent trustees being present, on a regular basis and at least two times each year. The Board of Trustees met in executive session threefour times during 2011.2012.

-14-

Our Board of Trustees believes that it is important for us to have a process whereby our shareholders may send communications to our Board. Accordingly, shareholders who wish to communicate with our Board of Trustees or a particular Trusteetrustee may do so by sending a letter to Darla Iverson, Secretary,Brittaney van der Hagen, Investor Relations Coordinator, at INREIT Real Estate Investment Trust, 2161711 Gold Drive South, Broadway, Suite 202, Minot,100, Fargo, ND 58701.58103. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Trustee Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of our Board of Trustees or only certain specified individual trustees. Ms. Iversonvan der Hagen copies all such letters and circulates them to the appropriate Trusteetrustee or Trustees.trustees.

Our Advisor is responsible for managing the day-to-day management of the risks we face, but the Board is actively involved in overseeing our risk management. The Board’s role in our risk oversight process includes receiving regular reports from our management and the Advisor, which include consideration of operational, financial, legal, regulatory and strategic risks facing us.we face. The Board does not view risk in isolation, as risks are considered in virtually every business decision made and as part of our business strategy. Accordingly, the Board also works to oversee risk through its consideration and authorization of significant matters, such as the adoption of basic policies such as the Code of Ethics and Insider Trading Policy; and through its oversight of the Advisor’s implementation of its duties. In addition, each of the Company’s Board committees considers risk within its area of responsibility, as follows:

The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in areas of financial risk, internal controls and compliance with legal and regulatory requirements.

The Nomination and Governance Committee assists the Board by overseeing the process of nominating trustee candidates; developing, reviewing and recommending to the Board corporate governance policies and a performance appraisal system to review performance of the Board and its committees; and review and recommend to the Board conflicts of interest matters.

-11-

The Disclosure Committee assists the Board with respect to risk management in the areas of public disclosure, disclosure controls and compliance with legal and regulatory requirements.

As a critical part of its risk management oversight role, the Board encourages full and open communication between the Advisor and the Board of Trustees. Trustees are free to communicate directly with the Advisor, and theAdvisor management of the Advisor attends the Board’s regular meetings of the Board and is available to address any questions or concerns raised by the Board on risk management-related and other matters.

During 2011,2012, we paid: (i) each of our Trustees,trustees, including the Chairman of the Board, $800$1,000 for each Board meeting the Trusteetrustee attends, (ii) the Chairman of the Board an additional $400 per Board meeting that the Chairman chairs, and (iii) each member of a Board committee $300$400 for each meeting the Trusteetrustee attends. However, if a Trustee was also an employee of our Advisor, we did not pay compensation for services rendered as a Trustee during 2011. Our Trusteestrustees are also reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at meetings. No other compensation such as stock awards, option awards, non-equity incentive plan compensation, nonqualified deferring compensation or any other type of compensation was paid or earned by Trusteestrustees in 2011.2012.

Effective January 1, 2012, the Board approved the following fees to be paid to its Board members for their services: (i) each Trustee, including the Chairman of the Board, $1,000 for each Board meeting the Trustee attends; (ii) the Chairman of the Board an additional $400 per Board meeting the Chairman chairs; and (iii) each member of a Board committee $400 each for each committee meeting the Trustee attends.

-15-

The chart below shows the amounts each trustee was paid for attending meetings during the year ended December 31, 2011.2012.

Trustee | Board of Trustees | Audit Committee | Governance and Nomination Committee | Executive Committee | Disclosure Committee | Board of Trustees | Audit Committee | Governance and Nomination Committee | Executive Committee | Disclosure Committee | Ad Hoc Committee | |||||||||||||||||||||||||||||||||

Timothy Hunt | $ | 3,200 | $ | 1,500 | $ | 0 | $ | 300 | $ | 0 | $ | 4,000 | $ | 2,000 | $ | 0 | $ | 1,200 | $ | 0 | $ | 0 | ||||||||||||||||||||||

Lawrence R. O’Callaghan | 3,200 | 0 | 600 | 0 | 600 | 4,000 | 0 | 800 | 0 | 1,600 | 400 | |||||||||||||||||||||||||||||||||

Rex R. Carlson | 800 | 900 | 0 | 0 | 0 | |||||||||||||||||||||||||||||||||||||||

Clifford Fearing | 3,200 | 1,500 | 0 | 0 | 600 | 4,000 | 2,000 | 0 | 0 | 1,600 | 0 | |||||||||||||||||||||||||||||||||

Richard Savageau | 3,200 | 0 | 600 | 300 | 0 | 3,000 | 0 | 800 | 1,600 | 0 | 400 | |||||||||||||||||||||||||||||||||

Peggy Becker | 3,200 | 1,200 | 0 | 0 | 300 | |||||||||||||||||||||||||||||||||||||||

Earl S. Strinden | 2,000 | 0 | 0 | 300 | 0 | |||||||||||||||||||||||||||||||||||||||

Bruce W. Furness | 4,400 | 0 | 600 | 600 | 0 | 5,600 | 0 | 800 | 1,600 | 0 | 400 | |||||||||||||||||||||||||||||||||

Lance R. Wolf | 3,200 | 1,500 | 0 | 0 | 600 | 4,000 | 2,000 | 0 | 0 | 1,600 | 0 | |||||||||||||||||||||||||||||||||

James R. Hansen | 2,400 | 0 | 300 | 300 | 0 | 4,000 | 0 | 800 | 1,600 | 0 | 400 | |||||||||||||||||||||||||||||||||

Kenneth P. Regan(1) | 0 | 0 | 0 | 0 | 0 | 4,000 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||||||||||

James S. Wieland(1) | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||||||||||||||||

James S. Wieland | 4,000 | 0 | 800 | 1,200 | 0 | 0 | ||||||||||||||||||||||||||||||||||||||

| $ | 28,800 | $ | 6,600 | $ | 2,100 | $ | 1,800 | $ | 2,100 | $ | 38,600 | (2) | $ | 6,800 | (2) | $ | 4,000 | $ | 7,200 | $ | 5,600 | (2) | $ | 1,600 | ||||||||||||||||||||

| (1) | An employee of the Advisor. |

| (2) | Includes $2,000, $800 and $800 paid, respectively to a former trustee. |

As an externally advised trust, our day-to-day operations are generally performed by our Advisor. Our President, Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary are also officers, employees, owners or governors of our Advisor. Among others, such executive officers oversee our Advisor’s day-to-day operations with respect to us. However, when doing so, such executive officers are acting on behalf of our Advisor in performing the Advisor’s obligations under the Advisory Agreement. Generally, the only services performed by our executive officers in their capacity as executive officers are those required by law or regulation, such as executing documents as required by North Dakota law and providing certifications required by the federal securities laws.

As of the date of this report, each of the persons below currently serves as one of our executive officers:

Name | Age* | Positions | Officer Since | |||||

| ||||||||

Kenneth P. Regan | 56 | Chief Executive Officer and Trustee | Trustee since January 2007 Appointed | |||||

Bradley J. Swenson | 47 | President and Secretary | December 2011 | |||||

Peter J. Winger | 55 | Chief Financial Officer and Treasurer | October 2007 | |||||

|

| * | As of April |

-12-

The following is a summary of the background and business experience of our executive officers other than Mr. Regan (whose background and business experiences are described in connection with his status as a Trustee)trustee):

Bradley J. Swensonhas served as our President since December 2011. He has also served as the President and a governor of INREIT Management, LLC since 2010. HeMr. Swenson has more than 18 years of leadership and management experience in corporate governance, operational strategy, ethics and compliance, real estate and the law. Prior to joining the Advisor, Mr. Swenson practice law in both the public and private sectors. In 1999, he was appointed Assistant Special Counsel to investigate the FBI stand-off and fire at the Branch Davidian compound in Waco, Texas. Upon completion of the investigation in 2001, Swenson joined the law firm of Dorsey and Whitney where he served ofOf Counsel until joining Ulteig Engineers as General Counsel and Corporate Secretary in 2004. Mr. Swenson was later named Ulteig’s Chief Operating Officer serving in that role until 2010. Mr. Swenson received a B.A. degree in English from the North Dakota State University and a J.D. degree from the University of Denver, College of Law. Mr. Swenson currently serves or has held leadership positions on numerous boards including the Board of Directors for the NDSU Research and Technology Park, the Board of Directors for the National Center for Employee Ownership, the Board of Trustees for the F-M Symphony, the Board of Directors for F-M Chamber of Commerce, the Board of Directors of the Downtown Community Partnership, the Executive Board for the Northern Lights Council, the Advisory Board for the Center for Ethical Leadership at Concordia College, the Executive Committee of the NDSU Alumni Association, and the Editorial Boards for the North Dakota and Missouri Bars.

-16-

Peter J. Wingerhas served as our Chief Financial Officer since October 2007. He has also served as the Chief Financial Officer of INREIT Management, LLC, our Advisor, since April 2008. Mr. Winger is a Certified Management Accountant. He is an experienced manager with knowledge and experience in operations and accounting in food manufacturing, retail, and real estate. Mr. Winger’s professional work experience includes four years as an assistant plant manager at two large dairy product manufacturing plants in Minnesota owned by Dairy Farmers of America, the largest dairy cooperative in the U.S. Prior to joining the Trust, he was the owner of a family business, Winger Cheese, Inc., where he served as Production Manager from 1984 to 2000 and President from 2000 until 2007. Between 2003 and 2008, Mr. Winger also owned and operated Pac ‘N Ship, a retail shipping store. Mr. Winger received a B.S. degree in Accounting and Business Administration from St. John’s University (MN), and an MBA from the University of Phoenix.

Darla Iversonhas served as our Secretary since April 2004. She also serves as an Investor Relations professional for INREIT Management, LLC, our Advisor, since June 2003. Ms. Iverson has over 25 years of experience in the REIT business. Previously, she worked for Odell-Wentz & Associates, the advisor to Investors Real Estate Trust, a publicly traded North Dakota REIT (Nasdaq: IREIT), between 1984 through 1987 and 1989 through 2003. She attended Capitol Commercial College in Bismarck, ND.

We have provided below certain information about the executive officers and Board of Governors of the Advisor.

Name | Age* | Position(s) | ||||

| ||||||

| ||||||

| ||||||

James D. Echtenkamp | 57 | Governor | ||||

Dale D. Lian | Governor | |||||

Kenneth P. Regan | 56 | Chief Executive Office, Chairman and Governor | ||||

Jon E. Strinden | Governor | |||||

Bradley J. Swenson | 47 | President and Governor | ||||

James S. Wieland | 61 | Governor | ||||

Bradley S. Williams | 56 | Governor | ||||

Peter J. Winger | 55 |

| * | As of April |

The following is a summary of the background and business experience of the executive officers and governors of the Advisor other than Messrs. Swenson, Regan, Winger and Wieland (whose background and business experiences are described in connection with their status as a Tusteetrustee or executive officer).

James DaleD. Echtenkamphas served as a governor of INREIT Management, LLC since 2007. He is a partner and principal of GOLDMARK Property Management, Inc., one of our property managers, since 1990. Prior, to that, he practiced law with Arthur, Chapman & McDonough from 1983 through 1989. He also served as a tax consultant for Touche Ross & Co. from 1981 to 1983. Mr. Echtenkamp serves on the Board of Directors of Private Bank, Minnesota. Mr. Echtenkamp received a B.S.B.A degree in accounting from the University of North Dakota and a J.D. degree from Drake University, School of Law. He also holds a real estate broker’s license in Minnesota and Nebraska, a series 62 and 63 securities license in Minnesota, and is licensed to practice law (inactive status) in Iowa and Minnesota. As of April 16, 2012,15, 2013, Mr. Echtenkamp’s spouse owned 6,266.89222,242.612 shares of the Trust, a family member owned 861.8581,064.395 shares of the Trust and a family trust owned 15,801.44117,530.167 shares of the Trust. In addition, as of such date, his spouse owned 109,137.106139,658.8060 limited partnership units and a family trust owned 2,433.405 limited partnership units, which may be exchanged for common shares of the Trust pursuant to the Exchange Right.

-17-

Dale D. Lianhas served as a governor of INREIT Management, LLC since January 2007. He is the President of GOLDMARK Development Corporation, which has provided development services to us since 2007. In this position, he oversees new construction and development and manages its financing and banking relationships. Prior, to that, he was a certified public accountant with Charles Bailly and Co., Fargo, where he focused on tax and accounting for small businesses. He also serves on the Board of Directors of GOLDMARK Property Management, Inc., one of our property managers; GOLDMARK Schlossman Commercial Real Estate Services, Inc.; and Board of Governors of JKJD, LLC,, all affiliates of the Advisor or the GOLDMARK companies. Mr. Lian received a B.S. degree in Accounting from the University of North Dakota. He hasis a Certified Public Accountant (CPA) which license is currently inactive; and he maintains a real estate license in North Dakota. He also has a series 62 securities license and is a registered representative of Gardner Financial Services Inc. As of April 16, 2012,15, 2013, Mr. Lian owned 488.915594.8932 shares of the Trust and 222,129.501213,684.9800 limited partnership units, and Dale D. Lian, LLC owned 3,444.521 units, all of which may be exchanged for common shares of the Trust pursuant to the Exchange Right.

-13-

Jon E. Strindenis an officer of Fredrikson & Byron, P.A., a law firm, since March 2010. Prior to joining Fredrikson, he was a partner at Dorsey & Whitney, LLP, a law firm, from December 1999 through March 2010. Mr. Strinden received a B.S.B.A. degree in Accounting and a J.D. degree from the University of North Dakota, School of Law. As of April 16, 2012,15, 2013, Mr. Strinden owned 35,319.05037,573.899 shares of the Trust, held in an IRA account, which the custodian has the power to vote such shares pursuant to the custodian agreement; and his spouse owned 3,658.6913,892.270 shares of the Trust.

Bradley S. Williamshas served as a governor of INREIT Management, LLC since 2007. Mr. Williams is the President and a partner of GOLDMARK Property Management, Inc., one of our property managers, from 2005 to the present. In this position, he oversees the management of more than 10,000 units of multifamily housing and over one million square feet of commercial property. He is also a partner and member of LBW Management, LLC, a business operation consultant, from 2004 to the present. Prior, to that, he was the Senior Vice President — Corporate Development for Varistar Corporation, a wholly-owned subsidiary of Otter Tail Corporation (NASDAQ: OTTR), an electric services and non-electric services (including plastics, manufacturing and health services) business, from 2000 to 2004. From 1999 to 2000, Mr. Williams was the Senior Vice President — Managing Director Europe for PepsiAmericas, Inc. (which has since been acquired by Pepsi-Cola Metropolitan Bottling Company, Inc. (NYSE: PEP)). In addition,Mr. Williams began his tenure with Pohlad Beverage Group in 1981 at an operation located in Joplin, Missouri. From 1988 to 1999, he was part of the Senior Management Team for the Pohlad Beverage Group from 1995 to 1999 and the President and Chief Operating Officer of Dakota Beverage Company, Inc. from 1993 to 1999. Mr. Williams is approximately a 30% owner and serves as a trustee of the Missouri Valley Real Estate Investment Trust, a private REIT that focusesfocusing on multifamily housing in South Central United States, and as a governor of such REIT’s advisor. Mr. Williams received a B.S.B.A. degree from Friends University in Wichita, Kansas. As of April 16, 2012,15, 2013, Mr. Williams beneficially owned 12,189.960 shares of the Trust, held in an IRA account, and the custodian has the power to vote such shares pursuant to the custodian agreement.

We are an externally advised trust and as such, although we have a Board of Trustees and executive officers responsible for our management, we have no paid employees. Our President, Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary are all employees of our Advisor, and receive compensation directly from the Advisor. Our Chairman of the Board is not an employee of our Advisor and receives compensation only for serving as a trustee.

The following is a brief description of the fees and compensation that may be received by the Advisor. The compensation payable to the Advisor is subject to the terms and conditions of the Advisory Agreement, which must be renewed on an annual basis and approved by a majority of the independent trustees. As a result, such amounts may be increased or decreased in future renewals of the Advisory Agreement. The fees listed below reflect the revised fees payable to the Advisor under the Advisory Agreement as amended and restated.

Management FeeFee:: 0.35% of our total assets, annually. Total assets are our gross assets as reflected on our consolidated financial statements, taken as of the end of the fiscal quarter last preceding the date of computation. The management fee will be payable monthly in cash or our common shares, at the option of the Advisor, not to exceed one-twelfth of 0.35% of the total assets as of the last day of the immediately preceding month. The management fee calculation is subject to quarterly and annual reconciliations. The management fee may be deferred at the option of the Advisor, without interest.

-18-

Reimbursement of Operating Expenses: Reimbursement by the Trust or the operating partnership for actual expenses incurred in connection with the operation of the Trust or the operating partnership. Reimbursement will be made each month, and within 45 days after receipt of a reimbursement request. Reimbursement will not be made to the extent it would exceed the greater of 2% of the average invested assets or 25% of net income per year, unless the Board of Trustees determines that such excess was justified.